How much money will really be available for debt service? (May 5, 2017)

On April 25, 2017, Assistant Town Manager for Finance Marc Puckett reprised for the Apple Valley Town Council his report of April 11, 2017, Financing the purchase of the water company — within existing rates.

As is to be expected in any report coming from the innumerate Mr. Puckett, there are errors and incorrect assumptions throughout. Let’s examine his figures for how much of a loan the Town can afford toward purchasing the water system via eminent domain, and calculate a better estimate.

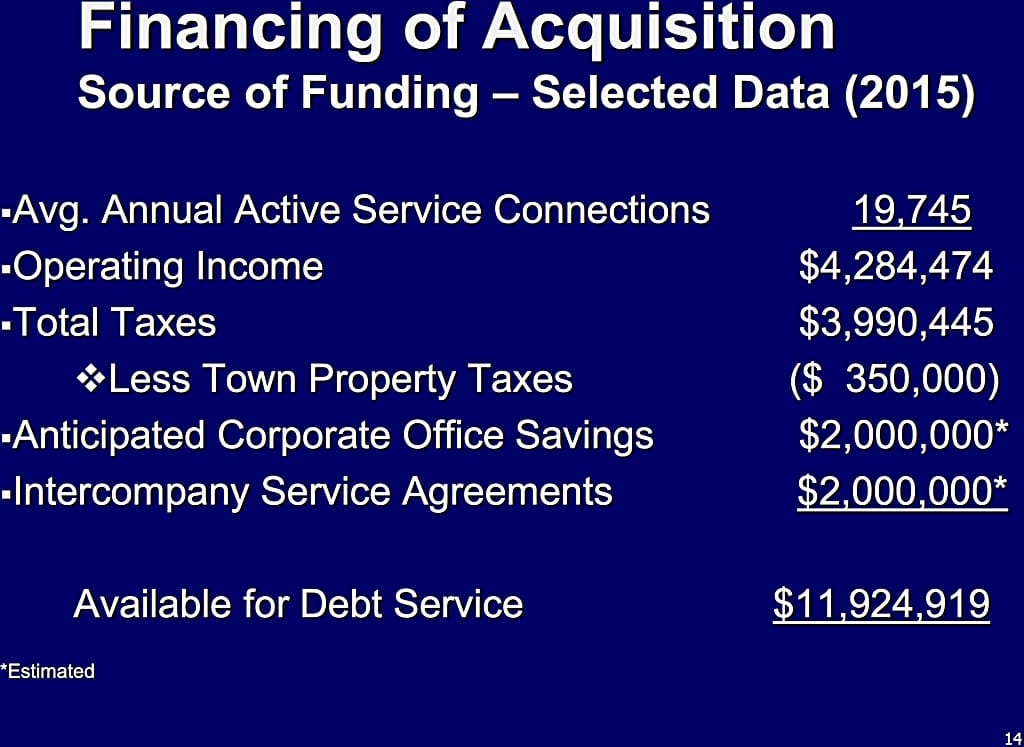

Page 14 of Mr. Puckett’s PowerPoint presentation contains a summary, which I have reproduced in the table below. (This summary also appears on a separate sheet, Preliminary Financial Analysis: Funds Available Under Current Rates for Debt Service

.) The first column headings are Mr. Puckett’s, as are the figures in the Puckett

column.

In the next column over (Actual

), I show the real numbers that Mr. Puckett should have used.

| Source | Puckett | Actual | Notes |

|---|---|---|---|

| Operating income | $4,284,474 | -$1,915,526 | a |

| Total taxes | $3,640,445 | $3,640,445 | |

| Corporate office | $2,000,000 | $0 | b |

| Intercompany agreements | $2,000,000 | $0 | c |

| Franchise fees | $0 | -$200,000 | d |

| Permits | $0 | -$16,000 | e |

| Total | $11,924,919 | $1,508,919 |

As you can see, Mr. Puckett’s calculation of how much the Town can afford in annual bond payments is off by $10,416,000 — not his biggest known error by any means but still substantial.

At the conservative rate

of interest used by Mr. Puckett to calculate the maximum affordable bond amount based on the Town’s savings

compared to continued operation under Liberty Utilities, $1,508,919 in annual bond payments back-calculates to a maximum bond size of somewhere around $23,871,730,f which is less than half of the already low offer the Town made to purchase Apple Valley Ranchos Water Company.g

Or, to look at it another way, if the Town spends the entire $150 millionh for which is it asking voters (and being politicians, what is there to stop them?), and pays the conservative rate

for the bond, it will mean an increase of $67.29 on the average bill. For water-conscious residents such as my wife and me, that would mean our water bill would double.

— Greg Raven is Co-Chair of Apple Valley Citizens for Government Accountability, and is concerned about quality of life issues.

Notes

- Operating income is used to make capital improvements to the water system. It is neither profit nor money that can be used for other things, such as paying off bond debt.

- Mr. Puckett’s figure here apparently is fabricated out of thin air.

- This figure represents monies spent by Liberty Utilities on experts, software, etc., and take advantage of economies of scale due to the fact that all Liberty Utilities water systems share in the expenses. If the Town were to replace these services and experts without that economy of scale, it would almost certainly cost more than the figure shown as savings by Mr. Puckett. It is shown here as zero savings to simplify this analysis.

- Not accounted for by Mr. Puckett.

- Not accounted for by Mr. Puckett.

- I have been unable to duplicate Mr. Puckett’s payment calculations using known formula. As my calculated payments are lower than his, this figure would likely be lower than if calculated using the Puckett Method.

- Liberty Utilities holds in excess of $68 million in water rights alone, in addition to the

465 miles of water mains; 24 wells; emergency generators; storage tanks; booster stations; and pressure zones

recognized by the Town. - The Town says the water system is worth $50 million. From Big Bear and other cities that have purchased private water systems, we know that the final price can easily be three times the promised price.